Authors:

Rakesh Ghirah

Londen & Van Holland, Partner

E: [email protected]

Ismail Agarmi

Londen & Van Holland, Senior Manager VAT (Indirect Tax)

E: [email protected]

Edited by:

Integra International

Grant Gilmour, B.Sc., MBA, CA, CPA Canada, BC, CPA USA, Az, GDipICL.Sc.

INTEGRA TAX WORLD NEWSLETTER EDITOR

E: [email protected]

Why e-Invoicing? The EU Commission Perspective

The European Union is undergoing the most significant structural transformation of its VAT system since the creation of the common VAT framework. This transformation is embodied in the “VAT in the Digital Age” (ViDA) legislative package, formally adopted through Directive (EU) 2025/516 and Regulation (EU) 2025/517 on 11 March 2025. ViDA represents a paradigm shift from periodic, ex post reporting-based VAT control systems towards continuous, transaction-based digital supervision models built on structured electronic invoicing and real-time digital reporting obligations. The policy objective of this reform is not merely administrative modernisation, but the structural redesign of VAT enforcement architecture in the internal market.

Electronic invoicing in the EU is legally grounded in Directive 2014/55/EU on electronic invoicing in public procurement, which established the European standard EN 16931 as a harmonised semantic data model for invoices. This legal framework ensures interoperability and legal certainty across Member States. ViDA builds upon this foundation by extending structured e‑invoicing from public procurement into the VAT compliance system. The policy justification is primarily linked to VAT gap reduction, defined as the difference between theoretical VAT liability (VTTL) and actual VAT collection. This enforcement gap has been identified by the European Commission and the EU Court of Auditors as a structural vulnerability in the EU tax system, justifying systemic digital controls

The Ladder of Evil – From Mistakes to Fraud

The so‑called “ladder of evil” illustrates the progression from unintentional mistakes to abuse of law, aggressive tax planning, and ultimately organised fraud. This conceptual model reflects EU tax enforcement theory, where compliance risks evolve in complexity and structure. ViDA’s digital reporting architecture addresses this by enabling pattern recognition, transaction linking, and behavioural analytics, which are not possible in periodic reporting systems.

At the core of this transformation lies the recognition that traditional VAT control mechanisms, which rely on periodic VAT returns, recapitulative statements and retrospective audits, are structurally incapable of addressing systemic and network-based fraud patterns. In particular, missing trader intra-Community (MTIC) fraud schemes, carousel fraud structures and organised VAT fraud networks exploit time lags, information asymmetries and jurisdictional fragmentation inherent in the existing VAT reporting model.

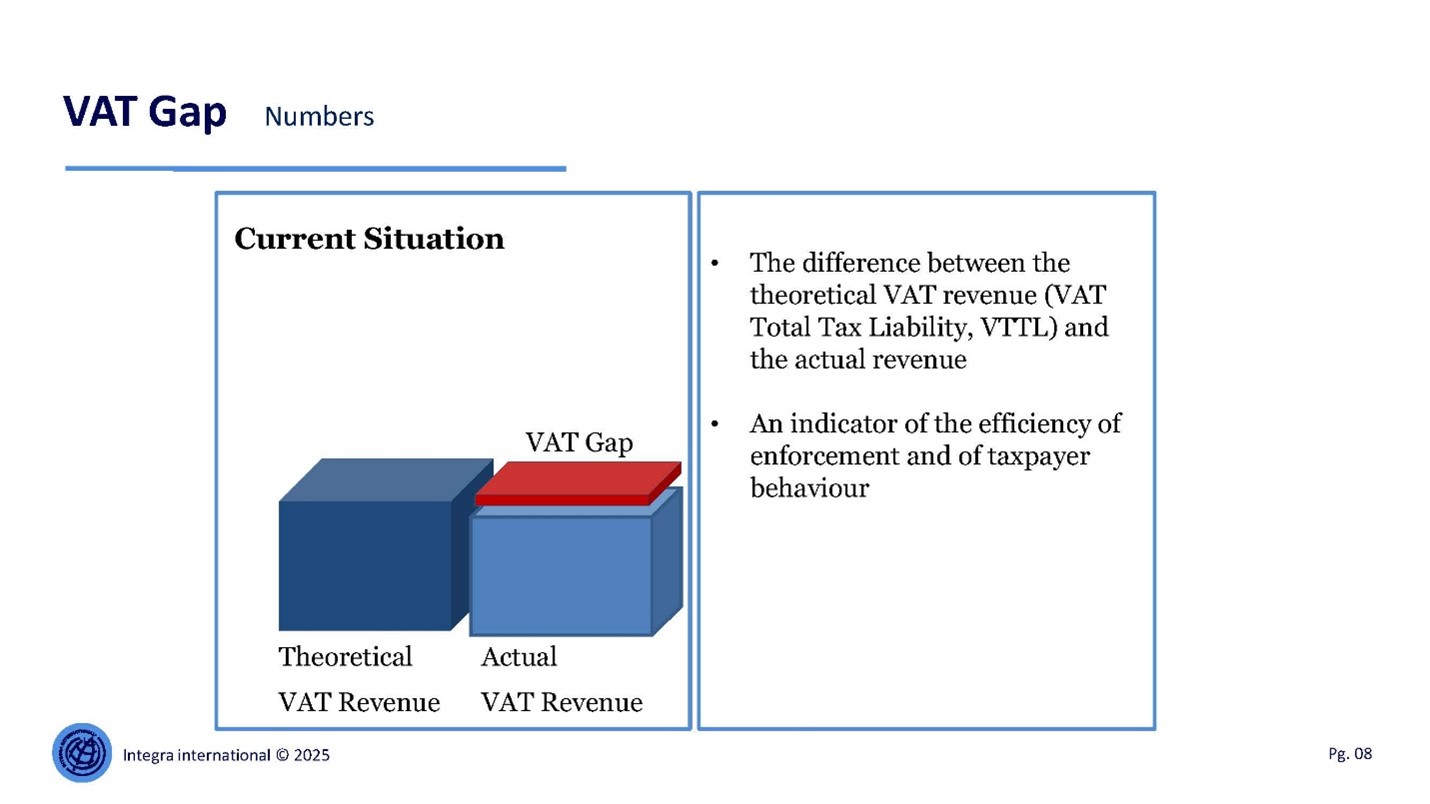

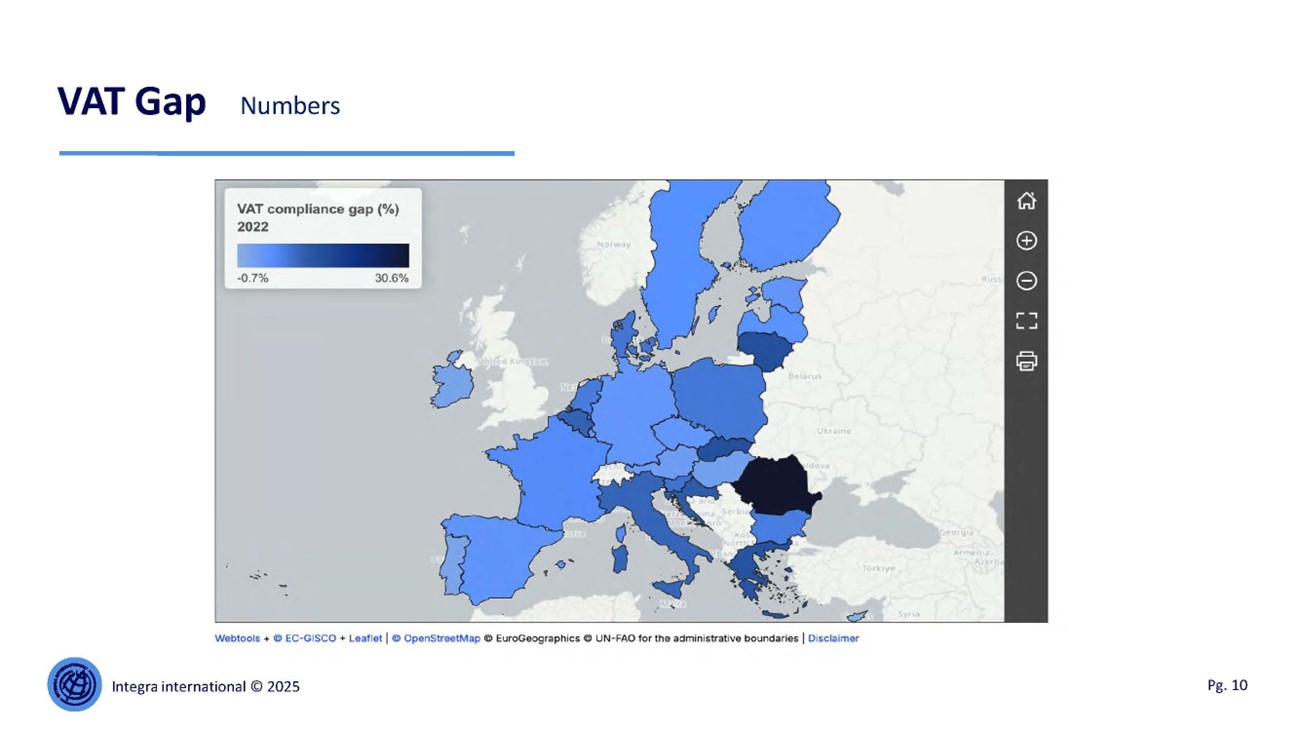

VAT Gap

The VAT Gap, defined as the difference between the theoretical VAT Total Tax Liability (VTTL) and the VAT actually collected, has therefore evolved from a statistical indicator into a core policy driver for regulatory intervention and is used by EU institutions as both a diagnostic and justificatory tool for legislative reform. It functions as an indicator of enforcement efficiency and taxpayer behaviour. The ViDA package is explicitly designed as a structural response to this gap, shifting from ex‑post auditing to ex‑ante transactional control, consistent with modern compliance theory and preventive regulation models.

VAT Gap Numbers

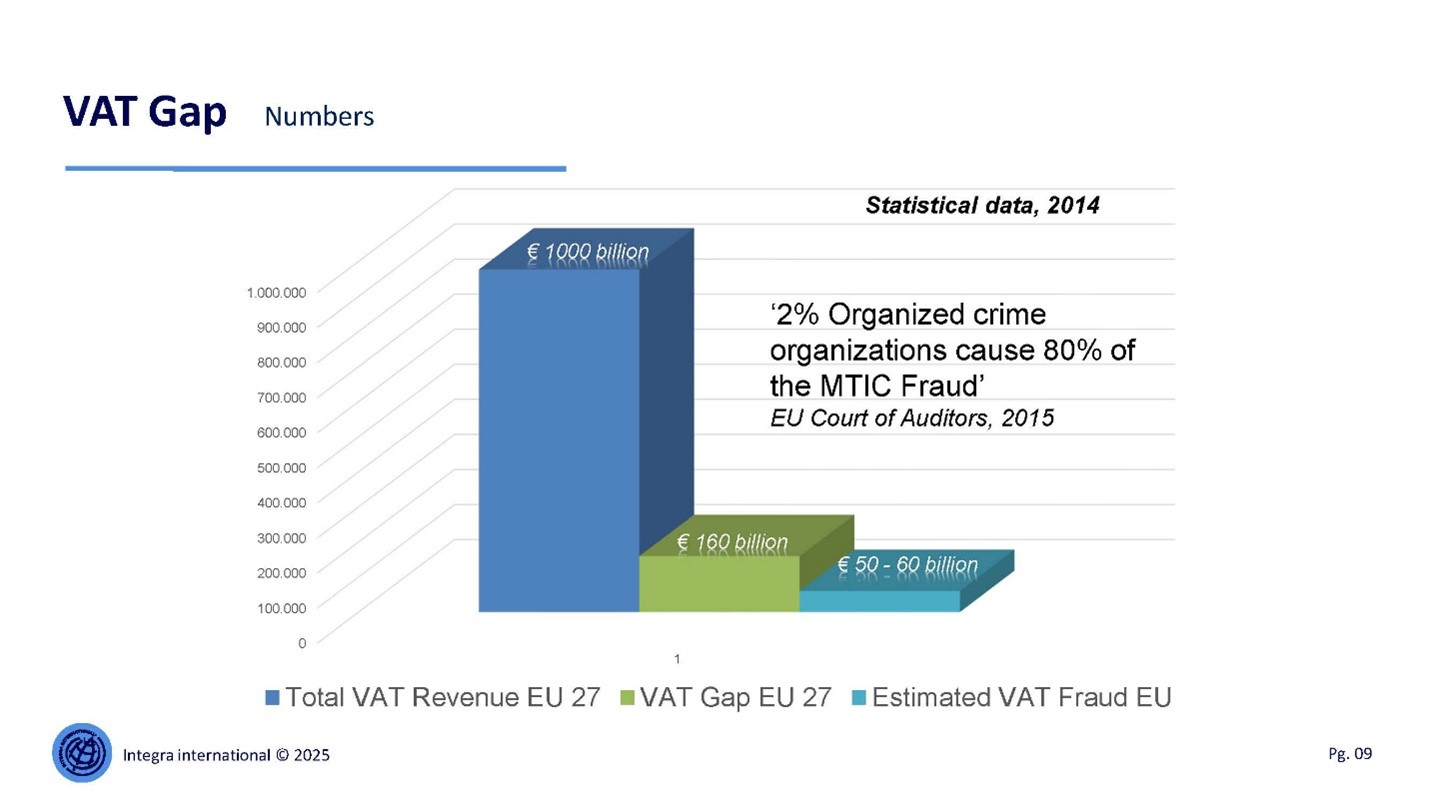

Empirical data from the EU Court of Auditors demonstrates that VAT fraud is highly concentrated within organised criminal structures, particularly in MTIC (Missing Trader Intra‑Community) fraud schemes. These schemes exploit cross‑border VAT exemptions and delayed reporting cycles. ViDA directly targets these vulnerabilities by eliminating temporal reporting gaps and enabling real‑time cross‑border data exchange. This is mainly operationalised through mandatory structured e-invoicing and digital reporting requirements (DRR), which transform invoices from passive accounting documents into active regulatory data carriers. Under the ViDA framework, invoices cease to function merely as evidence for accounting and audit purposes and become real-time data objects within a continuous supervisory ecosystem. This shift reflects a broader regulatory evolution from document-based compliance to data-based compliance models, aligning VAT control with developments already visible in customs, financial regulation and AML supervision frameworks.

ViDA-Digital Reporting

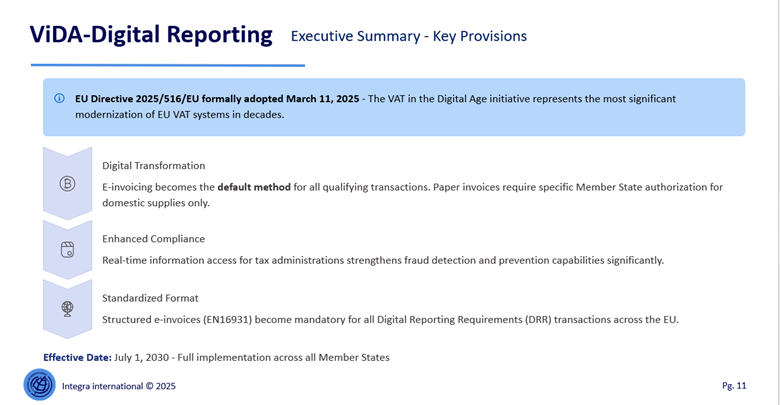

ViDA-Digital Reporting Executive Summary – Key Provisions

Directive (EU) 2025/516 establishes the legal foundation for ViDA, formally adopted on 11 March 2025. This directive created the first legally binding interoperability framework for structured electronic invoicing in the European Union, requiring Member States to accept compliant electronic invoices in public procurement and mandating harmonised semantic data models. EN 16931 does not merely define a technical format but establishes a legally harmonised data structure for VAT-relevant transactional information, thereby enabling cross-border semantic interoperability. ViDA builds directly on this foundation by extending the scope of structured invoicing from public procurement to the broader B2B and cross-border transactional environment. It introduces structured e‑invoicing as the default invoicing method, mandatory digital reporting requirements (DRR), and harmonised data standards. Structured electronic invoices compliant with EN 16931 become legally mandatory for qualifying transactions. The full implementation date of this framework is 1 July 2030, with transitional phases for national transposition.

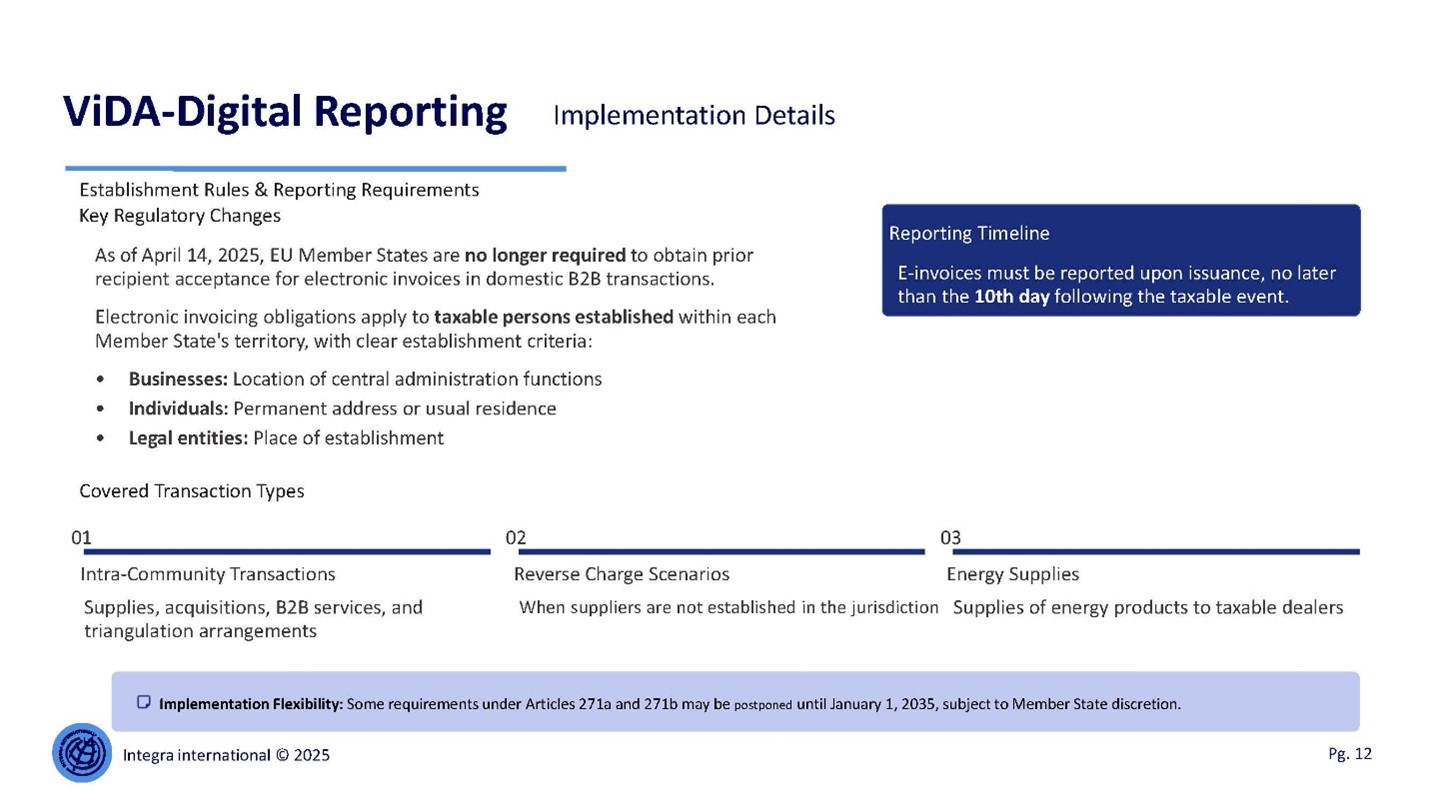

ViDA-Digital Reporting Implementation Details

ViDA abolishes the requirement for recipient consent for B2B electronic invoicing and introduces establishment‑based obligations. Taxable persons established within a Member State are subject to mandatory digital reporting obligations. The Digital Reporting Requirements established under ViDA impose transaction-level reporting obligations that fundamentally alter VAT compliance dynamics. E-invoices must be reported upon issuance and no later than the tenth day following the taxable event, thereby eliminating the temporal distance between economic activity and fiscal visibility. The scope of reporting includes intra-Community supplies and acquisitions, B2B services, triangulation transactions, reverse charge scenarios involving non-established suppliers and specific energy sector supplies. These reporting obligations create a continuous data flow from economic operators to tax administrations, enabling near real-time cross-border validation and automated risk analysis. Articles 271a and 271b of the Directive allow limited postponement options for certain obligations until 2035.

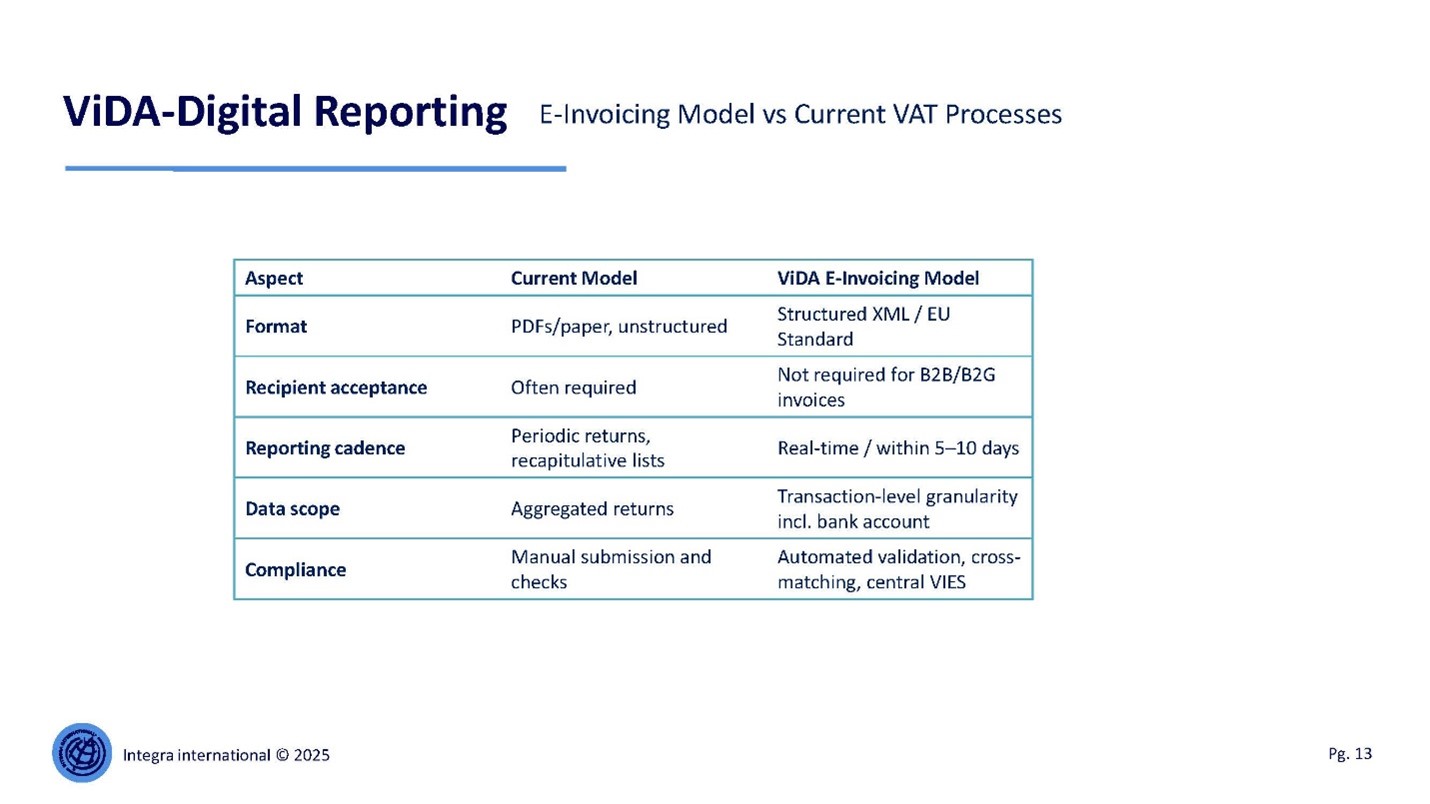

Directive (EU) 2025/516 introduces a fundamental regulatory shift by establishing structured electronic invoicing as the default invoicing method for qualifying transactions within the scope of the Digital Reporting Requirements. Paper invoices and unstructured formats such as PDFs are no longer regarded as standard compliance instruments but become exceptional methods requiring specific national authorisation for domestic transactions only. This reflects a reversal of regulatory logic: digital compliance becomes the norm, analogue compliance the exception. From 1 July 2030, structured electronic invoicing based on EN 16931 becomes mandatory for all qualifying intra-EU B2B transactions, thereby creating a uniform legal data layer for VAT reporting across the internal market.

Technical Standards & Formats

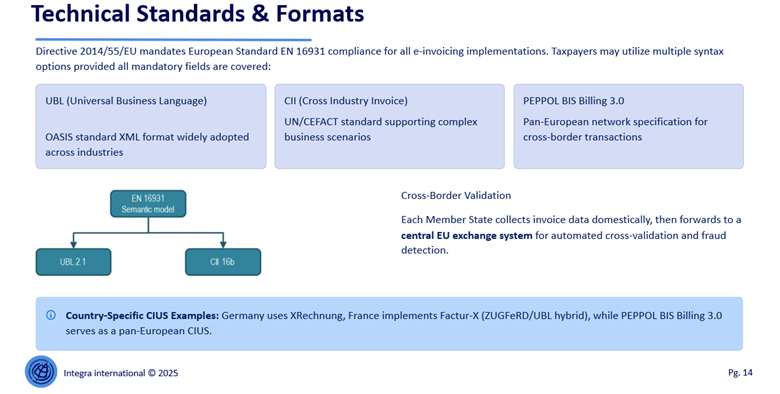

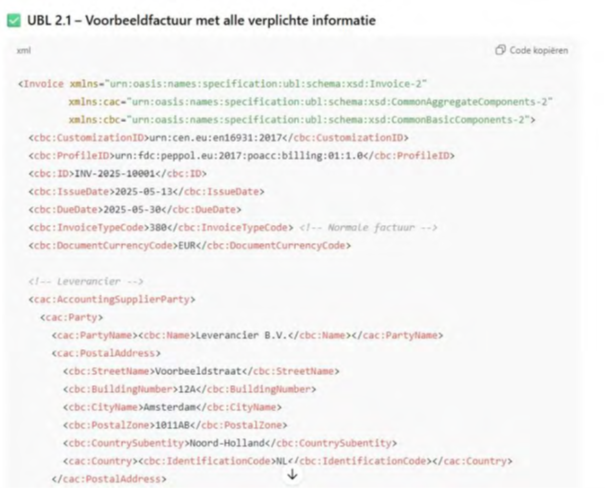

Technically, ViDA does not impose a single syntactic format but mandates compliance with the EN 16931 semantic standard. Multiple syntaxes are permitted, including Universal Business Language (UBL), Cross Industry Invoice (CII) and PEPPOL BIS Billing 3.0, provided that all mandatory data elements defined by the European standard are present. This reflects the EU’s regulatory approach of semantic harmonisation combined with technical pluralism, allowing interoperability without imposing a single technological architecture. Cross-border validation is achieved through a decentralised collection model, in which Member States collect invoice data domestically and forward structured data to a central EU exchange system for automated cross-border matching and fraud detection

The regulatory architecture created by ViDA therefore represents a hybrid governance model combining decentralised national infrastructures with centralised EU-level data coordination. This model preserves Member State sovereignty over tax administration while enabling EU-level systemic supervision of cross-border VAT flows. It reflects a constitutional balance between subsidiarity and harmonisation, operationalised through technical interoperability rather than institutional centralization.

Supported Technical Implementations – Samples

EN 16931 + PEPPOL BIS Billing 3.0

- The most widely adopted combination for pan-European e-invoicing, providing comprehensive interoperability and automated processing capabilities.

EN 16931 + CII 16B

- UN/CEFACT Cross Industry Invoice standard, particularly suitable for complex supply chain scenarios and industrial applications requiring detailed product specifications

Both implementations ensure full compliance with ViDA requirements while offering flexibility for different business needs and technical infrastructures.

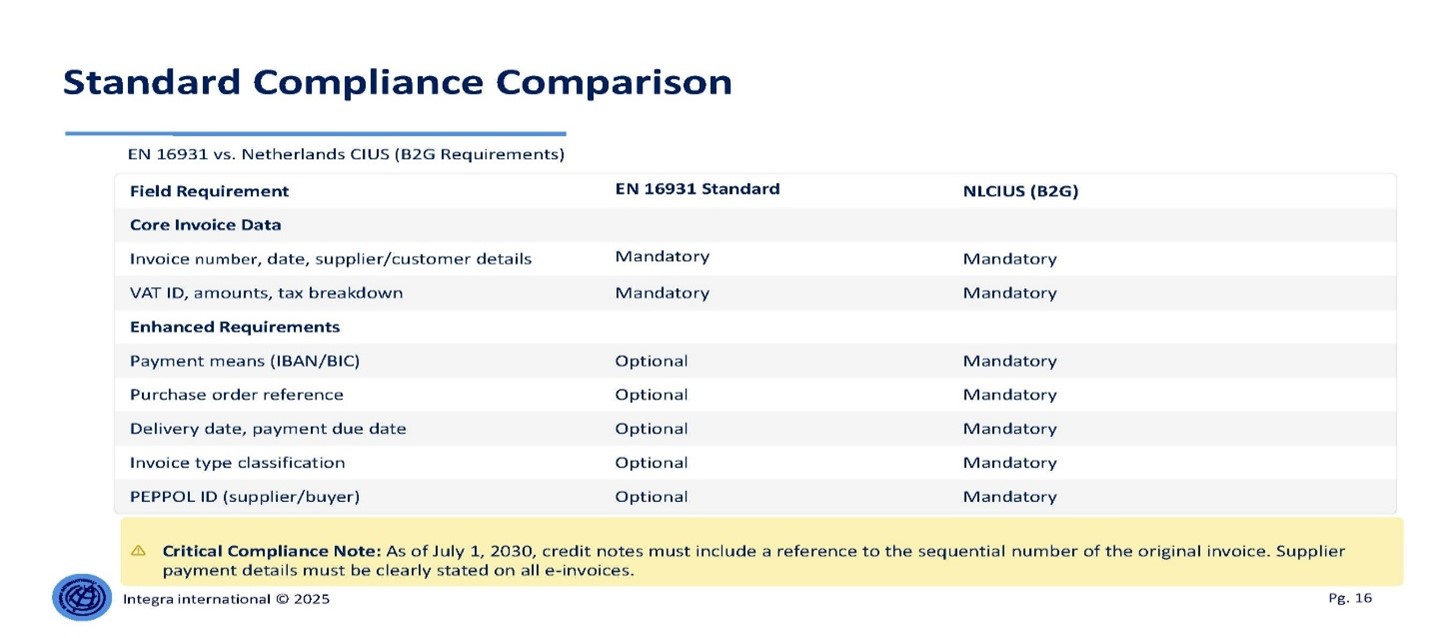

Standard Compliance Comparison

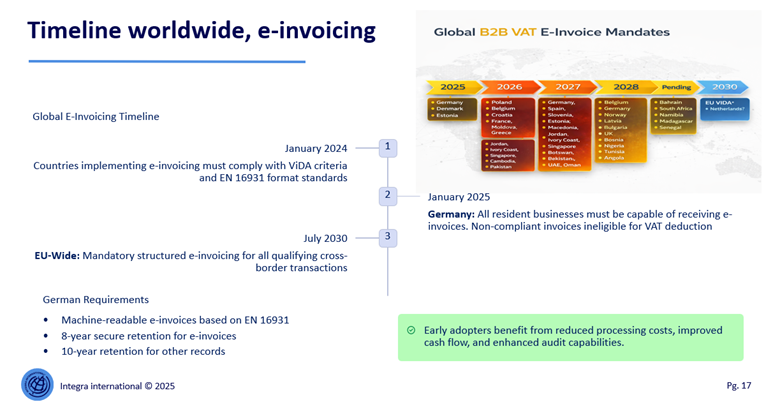

Timeline worldwide, e-invoicing

ViDA also aligns EU VAT compliance with global e‑invoicing developments, particularly in jurisdictions that have already implemented real‑time reporting systems (e.g. Latin America). This positions the EU within a global shift towards continuous transaction controls (CTC models).

Overview Current and Future Developments

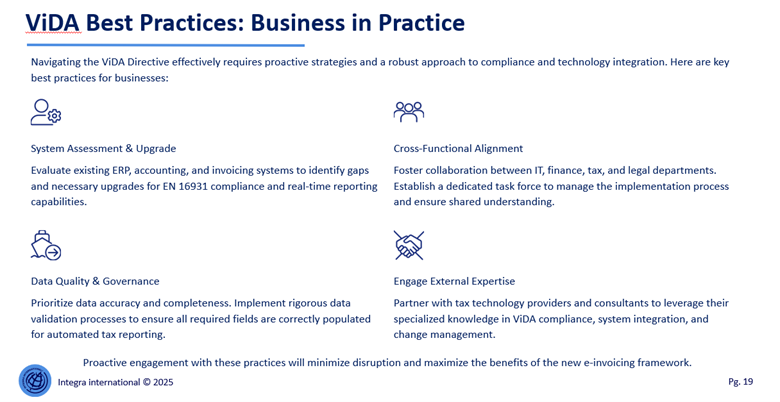

ViDA Best Practices: Business in Practice

To succeed under the ViDA framework, businesses should treat e-invoicing and real-time reporting as a strategic transformation, not a compliance exercise. Early system readiness is critical: organizations should assess ERP, finance, and invoicing platforms now, close technical gaps, and ensure alignment with EN 16931 and real-time reporting standards. At the same time, investing in strong data quality and governance models will prevent downstream compliance risks, automation failures, and reporting inconsistencies.

Equally, ViDA readiness depends on people and processes as much as technology. Companies should establish cross-functional ownership, clear governance structures, and shared accountability between tax, finance, IT, and legal teams. Engaging specialized external partners can accelerate implementation, reduce regulatory interpretation risks, and support scalable system integration. Businesses that act early, coordinate internally, and standardize their approach will not only achieve compliance more efficiently, but also unlock long-term operational efficiency and digital resilience.

Disclaimer

This communication contains general information only based on collective research. Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser. No representations, warranties or undertakings (express or implied) are given as to the accuracy or completeness of the information in this communication, and none of Londen & Van Holland, Integra International, related entities, employees or agents shall be liable or responsible for any loss or damage whatsoever arising directly or indirectly in connection with any person relying on this communication.

Londen & Van Holland and Integra International, and their related entities, are legally separate and independent entities.

© 2026 Integra and Londen & Van Holland

About the Authors:

Rakesh Ghirah

Rakesh Ghirah is a partner of the Indirect Tax department at London & Van Holland. Within the Indirect Tax department, he is involved in VAT and RETT (real estate transfer tax) advice for various types of customers and regularly provides VAT trainings. He also works as a thesis supervisor at the law & tax department of Erasmus University and is the programme coordinator of the Post-Master Indirect Tax at Erasmus Fiscal Studies. He previously worked as a VAT specialist at the Dutch Tax Authorities and the Ministry of Finance of the Netherlands.

Ismail Agarmi

Ismail Agarmis is a Senior Manager VAT (Indirect Tax) at Londen & Van Holland, advising businesses on complex national and cross‑border VAT matters and helping organizations optimize compliance, reduce risk, and unlock financial opportunities within indirect tax systems. He has extensive experience advising multinational and national companies across a wide range of sectors, including international trade, toll manufacturing, automotive, e‑commerce, petrochemicals, electronics, and other internationally oriented industries. In addition to his tax‑technical expertise, Ismail is specialized in tax technology, including VAT compliance automation, VAT mapping across various ERP systems, and the design of technology‑enabled indirect tax processes. He has previously worked as VAT specialist at Big 4 firms both in the Netherlands and various multinational firms.

About Londen & Van Holland:

Londen & Van Holland was established in 1994 – large enough to provide the range of services that would enable it to compete against the existing big four but, at the same time, small enough to give its staff space for personal development. The company has grown into a medium-sized organization with around 60 staff with clients ranging from independent companies to subsidiaries of international companies and non-profit organizations.

Integra International Bio:

https://integra-international.net/find-an-integra-firm/find-firm-profile/name/londen-van-holland/

Londen & Van Holland: