Originally Published in Spanish, Please look at the bottom of the article for the Spanish Version.

Publicado originalmente en español, consulte la parte inferior del artículo para ver la versión en español.

Author:

Lic. Salvador Pizano Moreno

Gerente/ Manager

[email protected]

Edited by:

Grant Gilmour, B.SC., MBA, CPA BC, CA, CPA AZ

Integra Tax World Newsletter Editor

E: [email protected]

Transfer pricing, an important and controllable aspect of international taxation, refers to the prices at which companies within an international corporate group transfer goods, services, or intangible assets between each other. The forward at paragraph 11 of the OECD Transfer Pricing Guides. Says

“These are the prices at which a company transfers tangible goods and intangible assets or provides services to associated companies.”

Transactions between companies in a group that are subject to Transfer Pricing are:

- Financing operations

- Provision of services

- Use, enjoyment or disposal of tangible property

- Exploitation and transfer of intangible assets

- Disposal of shares

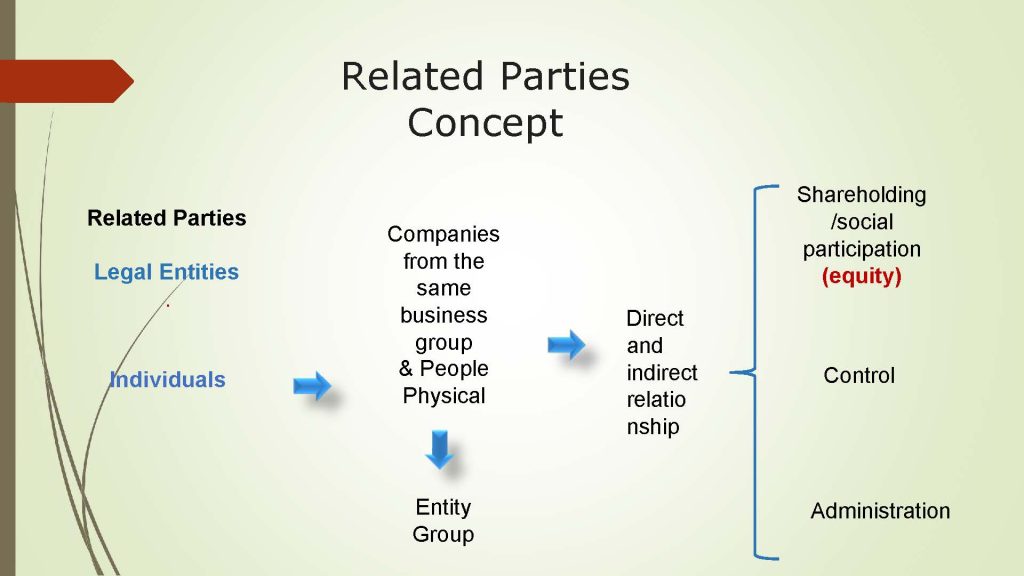

The related party concept is core to a conversation about transfer pricing. We can look at:

OECD Model Convention Article 9

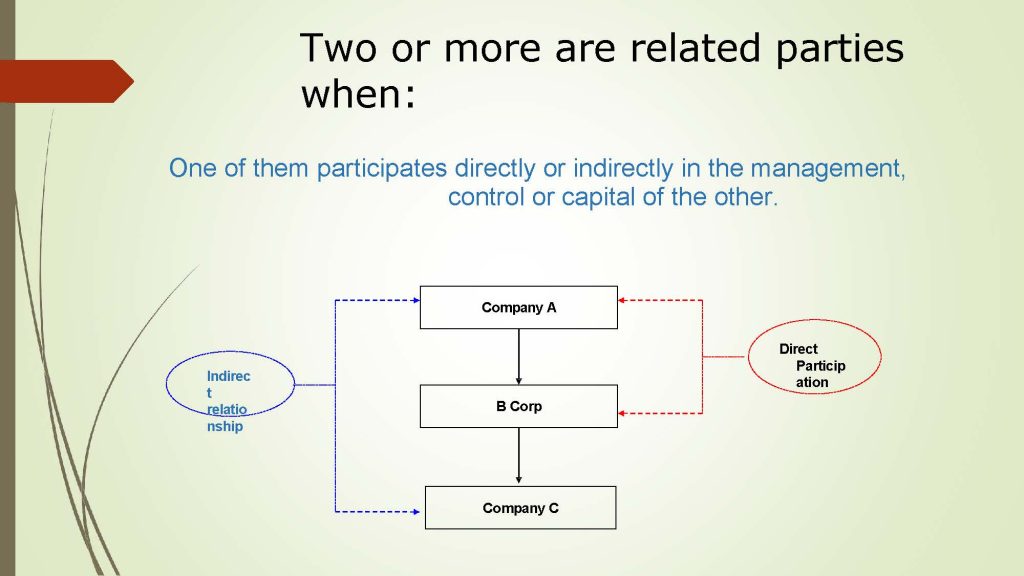

1.“When:

a) an enterprise of one Contracting State participates directly or indirectly in the management, control or capital of an enterprise of the other Contracting State, or

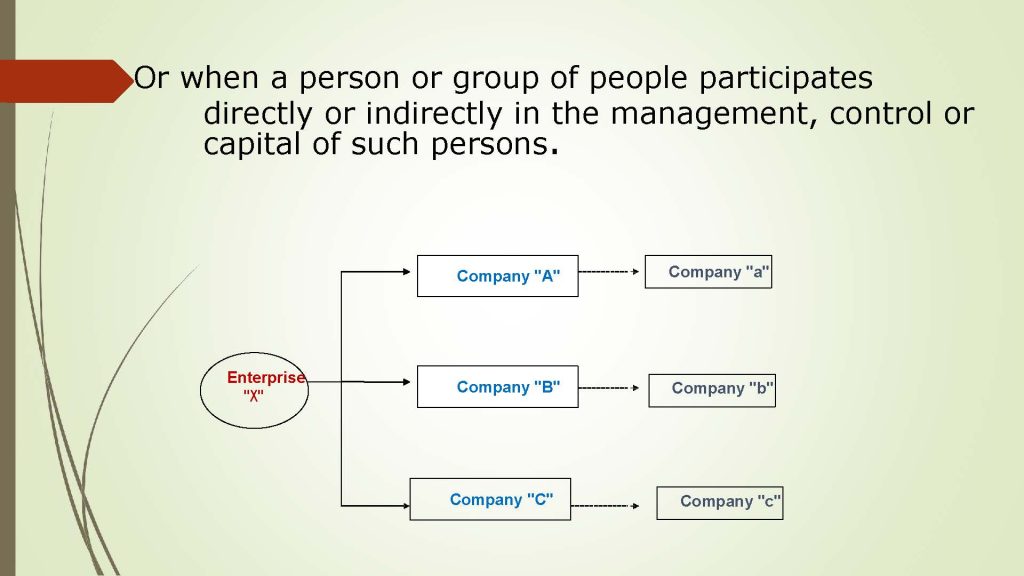

b) the same people participate directly or indirectly in management, control or capital of an undertaking of one Contracting State and of an undertaking of the other Contracting State …”

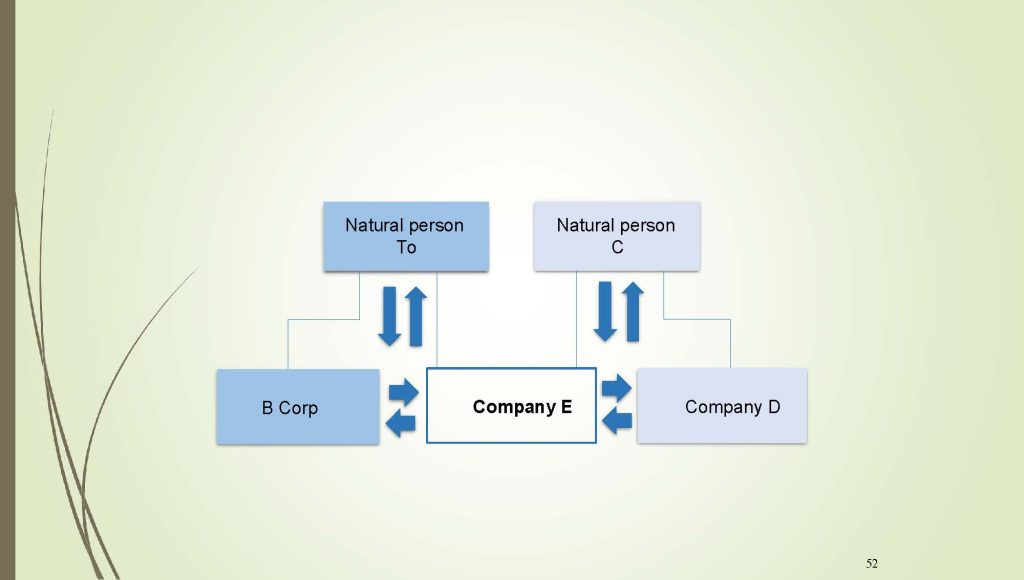

The related party concept is illustrated here:

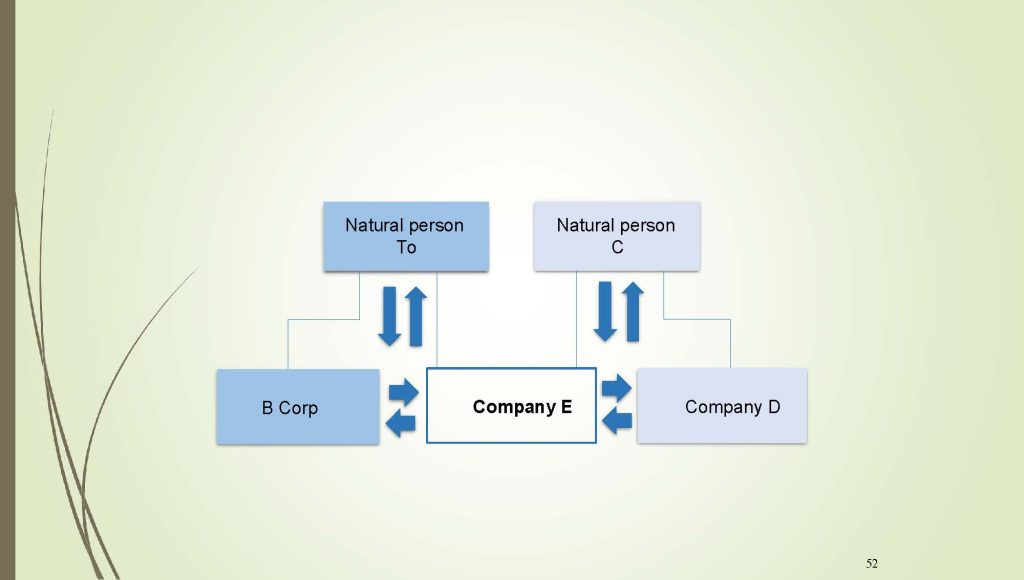

Company A and Company B are related because of the family relationship between Dad and Son.

Sometimes the chain of relationship can be long. Notice in the illustrations that Company A and C are related because of the joint indirect ownership of Company E and likewise two natural persons’ might find that they are related for transfer pricing because of a joint ownership.

TRANSFER PRICING TARGET FOR ANALYSIS

The target of the analysis is International transactions which will lead to different domestic results from transactions and thus different taxation results. This is why tax authorities are interested.

Market Value Principle (Arm’s length)

There are two broad approaches

- Economic approach

Commercial and financial relationships between related parties must be agreed on the same terms and conditions as independent companies.

- Fiscal Approach

Proper distribution of profits among related parties for the purposes of fair payment of taxes.

The first option for analysis is looking at comparable transactions or companies.

Application of the Market Value Principle through the use of comparable operations or companies.

WHAT ARE CONSIDERED COMPARABLE OPERATIONS OR COMPANIES?

If we look at the tax provisions in Mexico we find. (translated)

“…, when there are no differences between them that significantly affect the price or amount of the consideration or the margin of

The methods set forth in section 180 of this Act shall be eliminated where such differences exist, and where such differences exist, shall be eliminated by reasonable accommodation. In order to determine such differences, the relevant elements required shall be taken into account , depending on the method used, …”

THINGS TO CONSIDER WHEN LOOKING FOR COMPARABLE COMPANIES

- Functions, assets used and risks similar to those of the company under analysis.

- Public and current financial information available.

Comparability Factors

- Characteristics of operations

- Function analysis.

- Contractual Terms.

- Economic circumstances.

- Business strategy.

There can be both Internal and external comparables

INTERNAL COMPARABLES

Internal comparables.- The transactions that a company carries out with its related party(s) are the same as those that it also carries out with independent party(s) under the same conditions and terms. An example is a manufacturer with both internal customers and external, customers. The comparable for the internal customers is the external customers.

EXTERNAL COMPARABLES

External comparables.- in the case of operations that a company only carries out with its related parties and there are no transactions within the company internal supply chain with independent third parties we must search for comparable companies or operations outside of the global enterprise.

- We can Search for comparable market benchmarks (public companies). This can be publicly available information. But the details may be hard to discern and require in depth research. These comparable companies are not going to freely disclose their internal data unless compelled by law and when they do it will be a very macroscopic top level.

- We can Search for comparable contracts. All or part of these may be publicly available because of access to information by governments or databases available for a fee. These contracts will have more details but may have other economic implications that are not part of the comparison we are trying to make.

- We can Search for comparable market benchmarks for example real estate leases that may have publicly published information.

TRANSFER PRICING METHODS

There are six methods for developing a transfer price and for the underlying analysis.

I. Comparable Price Not Controlled

II. Resale Price

III.Added Cost

IV. Profit Sharing

V. Profit Sharing Residual

VI. Transactional Profit Margins

ECONOMIC ANALYSIS

First and second paragraphs of Article 180 of the Ley Del Impuesto Sobre La Renta (LISR)The Law in Income tax for Mexico. (Translated) talk about the method chosen for Transfer Pricing leads to a range of Values that leads to the results of the transaction.

“From the application of any of the methods indicated in this article, a range of prices, amounts of consideration or profit margins may be obtained, when there are two or more comparable transactions. These ranges will be adjusted by applying statistical methods. If the price, amount of the consideration or profit margin of the taxpayer is within these ranges, such prices, amounts or margins shall be considered as agreed or used between independent parties…”

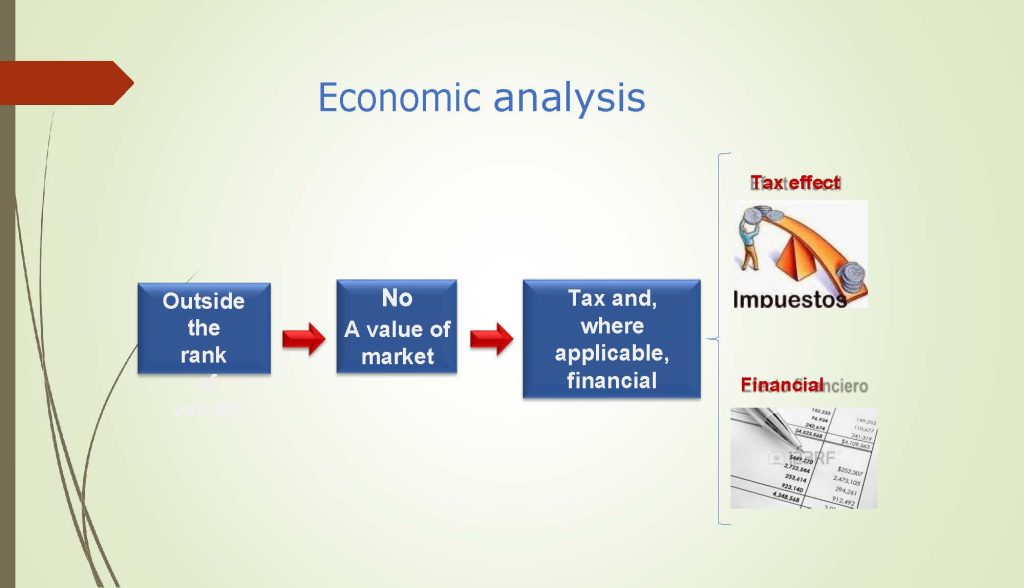

Looking back at the various methods of transfer pricing we can see that economic analysis will provide a range of values:

We can ask the question: What happens when the result of the intercompany operation is outside the value ranges? The answer is in the LISR (translated)

“… In the event that the taxpayer is outside the adjusted range, the price or amount of the consideration used by independent parties shall be deemed to be the median of such range.”

Usually the taxation authorities have the power to require a change in the transfer price used and make adjustments. These adjustments will have a tax effect and will also have a financial impact from the tax and the economic impact of a revised price on actual profits.

COMPARISON OF TAX OBLIGATIONS FOR RELATED PARTIES IN LATIN AMERICA

COLOMBIA

In Colombia, the tax regulations oblige for the transfer pricing regime (article 260 – 1 to 260 – 11 of the Tax Statute and Decree 2120 of 2017) to taxpayers of Income Tax and complementary taxpayers who enter into transactions with foreign related parties, such must carry out their operations in compliance with the Arm’s Length Principle. In September, the implementation begins for compliance with the formal obligations of the transfer pricing regime in Colombia, according to which transactions at market prices carried out with economic affiliates abroad, free zones or entities resident in non-cooperative jurisdictions, with low or no taxation, must be reported. Submission requirements and dates are summarized below.

Statements are required from entities to be made to the authorities

The following types of taxpayers must submit the declaration:

- Income taxpayers, whose gross assets on the last day of the taxable year or period are equal to or greater than the equivalent of 100,000 UVT ($3,800,400,000) or whose gross income for the respective year is equal to or greater than 61,000 UVT ($2,318,244,000), who have entered into transactions with economic related parties located abroad or free zone during the taxable year.

- Income taxpayers who have carried out transactions with persons, companies, entities or companies located resident or domiciled in non-cooperative jurisdictions, with low or no taxation and preferential tax regimes, even if their gross assets or gross income in the same year had been lower than the ceilings indicated above.

Local Report

This report must be submitted by those taxpayers who are required to file the threshold for the above declarations and that also meet any of the following criteria:

- Have registered transactions with economic associates located abroad or free zone equal to or greater than 45,000 UVT ($1,710,180,000).

- Have registered transactions with persons, companies, entities or companies located resident or domiciled in non-cooperative jurisdictions, with low or no taxation and preferential tax regimes, equal to or greater than 10,000 UVT ($380,040,000).

The filing due date of the Information Return and the Local Report is established according to the last digit of the NIT.

GUATEMALA

In accordance with Article 56 of Decree 10-2012, related parties shall be understood as a person resident in Guatemala and a resident abroad, when the following cases arise:

- When one of them directs or controls the other, or owns directly or indirectly, at least 25% of its share capital or voting rights, whether in the domestic or foreign entity.

- When five or fewer persons direct or control both related parties, or collectively own, directly or indirectly, at least 25% of the share capital or voting rights of both persons.

- In the case of legal entities, whether resident in Guatemala or abroad, that belong to the same business group, these effects are considered that two companies are part of the same business group if one of them is a partner or participant of the other and is in one of the following situations:

- Possess a majority of the voting rights.

- Have the power to appoint and dismiss the members of the governing body.

- It may, by virtue of agreements concluded with other partners, have the majority of the voting rights.

- Has appointed the majority of the members of the administrative body exclusively with its votes.

- The majority of the members of the board of directors of the controlled legal entity, whether they are managers or members of the board of directors of the parent company.

Article 65, paragraph 1, of the Law establishes the obligation of the taxpayer to have at the time of filing the Income Tax Affidavit, sufficient information and analysis to demonstrate and justify the correct determination of prices between related parties (transfer pricing study).

This documentation is necessary for the completion of the Annex on Transactions with Related Parties, which is submitted together with the Annual Income Tax Affidavit no later than March 31 of the year immediately following the period to be declared, so it is advisable to have it. In accordance with Article 65 of Decree 10-2012, the supporting documentation or transfer pricing study must only be submitted by the taxpayer to the Tax Authority, when the latter so requests in writing. To comply with this obligation, the Tax Authority grants a maximum period of 20 working days, counted from the day after receiving the notification.

PANAMA

Transfer pricing documentation is formally legislated within Chapter IX of the Tax Code of the Republic of Panama, added according to Article 1, Law 33 of 2010, as amended by Law 52-2012. In addition, Article 762-D of the Code states that, for the interpretation of the legal provisions on transfer pricing, the Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations, approved by the Organisation for Economic Co-operation and Development, shall be applicable. Similarly, the transfer pricing regime is applicable to any transaction that is established in Panama or that is a tax resident of other jurisdictions or that is established in the following zones:

- Petroleum Free Zone;

- Colon Free Zone;

- Panama Pacific Special Economic Area;

- Headquarters of Multinational Companies;

- City of Knowledge; or

- Any current or future economic benefit zone

Although the Tax Code of the Republic of Panama does not establish a date for the preparation of the transfer pricing study, for the purposes of the informative return of related parties, it must be previously prepared, so it is recommended that the taxpayer has the study before the filing of said return. As for the study or documentation of transfer pricing, this must be kept by the taxpayer, and made available to the Tax Administration when requested through written communication for the purposes of reviews or audits. If required, the taxpayer will have a period of 45 working days to deliver it. Regarding the Country-by-Country Report, it must be sent through the FATCA/AEOI portal no later than 12 months after the end of the fiscal year being reported. As of fiscal year 2019, Panama implemented the obligation to submit a Country-by-Country Report as established in BEPS Action 13. In addition, the DGI has sent to the professional associations the draft of a bill that adds Article 762-L to Chapter IX of Title I of the Tax Code, which proposes to include Advance Transfer Pricing Agreements (“APAs”) within the Tax Code of the Republic of Panama. The APA is one of the existing methods at the international level, established by both the OECD and the United Nations, to establish by agreement between the Tax Administrations and taxpayers.

ECUADOR

In Ecuador, the transfer pricing regime is based on the Organic Law of the Internal Tax Regime (LORTI) and the Regulations for the application of the Internal Tax Regime Law (RLRTI), which detail the tax regulations to which taxpayers described in the regulation are subject. Likewise, Ecuadorian legislation makes technical reference to the Guidelines of the Organization for Economic Co-operation and Development (OECD), even though Ecuador is not part of this organization. In addition, Article 4 of the RLRTI defines the criteria for establishing the relationship between related parties, either by percentage of capital or by the proportion of transactions. In Ecuador, companies that are required to submit transfer pricing information are those that meet certain criteria set out in the country’s tax legislation. According to Ecuadorian regulations, the companies that must submit the Transfer Pricing Report and Annex are those that carry out transactions with related parties resident or domiciled abroad and that meet any of the following requirements during the fiscal year:

- Taxpayers who carry out cumulative transactions with related parties greater than 15 million during the same fiscal year are required to file the Comprehensive Transfer Pricing Report and the Annex of Transactions with related parties.

- Those who have carried out transactions with related parties for a cumulative amount exceeding US $3 million must submit the Annex of Transactions with Related Parties.

Failure to comply with transfer pricing obligations may be sanctioned by the Tax Administration with fines of up to 15,000 US dollars, as established in Article 99 of the Tax Code. For those taxpayers who carry out intercompany transactions greater than $15 million USD, they must file within a period of no more than two months after the filing of the annual income tax return according to the deadline established by the SRI according to the ninth digit of their RUC, however, for those who do not exceed that amount of transactions, In the same way, it will be necessary that they have their study ready, since from there the information will be obtained to file the Informative Transfer Pricing Return.

MEXICO

The regulation of transfer pricing in Mexico is established in article 76 sections IX, X and XII, as well as Articles 179 and 180 of the Income Tax Law (“LISR”). Sections IX and XII of Article 76 .

Information Return:

Article 76 section X of the LISR establishes that information on transactions carried out with foreign and national related parties, carried out during the immediately preceding calendar year, must be submitted no later than May 15 (previously March 31). This statement is contained in Annex 9 of the Multiple Information Statement (DIM). The information requested in this statement includes identification data of each of the related parties, type and amounts of transactions that were carried out with each related party, the transfer pricing methodology applied for each transaction including the ranges of values determined when comparable values have been used. In addition, data related to the searches carried out in the study, adjustments applied during the year and mention if the transfer pricing study is available. In the case of the local information return of related parties, it must be filed no later than May 15 (previously December 31) of the year immediately following the tax year in question.

ARGENTINA

Transfer pricing provisions in Argentina are mainly regulated by the Income Tax Law (“LIG”) and its respective amendments, being complemented and regulated by subsequent Decrees and General Resolutions, including Decree 1344/98, as well as General Resolution No. 1122, General Resolution 3132/2011 and General Resolution 3476/2013. In the LIG, the matter of transfer pricing is related to the determination of prices at full concurrence value of international transactions entered into between taxpayers and related subjects, when the latter are incorporated, domiciled or located outside the national territory.

Transfer Pricing Statement in Argentina

Article 21.30 of the Regulations states that taxpayers covered by the transfer pricing rules must file certain informative affidavits, such as Local Report or also known as Transfer Pricing Study, Master File and Country-by-Country Report (CbC Report).

Deadline for Returns

In the case of the Transfer Pricing Study and Form 2668, they must be submitted up until the sixth month after its closing, according to the last digit of the C.U.I.T. The Master Report and Country-by-Country Report must be submitted by the twelfth month following the of its closing, according to the last digit of C.U.I.T.

SPAIN

Transfer pricing is regulated in Spanish tax legislation, through the

LIS2 (Article 18) and RLIS3 (Articles 15, 16, 17, 19, 20, and 31-36). The establishment of prices between the related parties involved must be documented, since the tax agency has the power to adjust the transfer prices if it considers that they differ from those that would be stipulated between independent parties. Spain (Article 18.3, LIS, and Articles 15 and 16, RIS). Documentation obligations are complex, as different types of documents are established depending on the category (in millions). There is a simplified regime for entities with a turnover of less than €45 million, with exceptions. Spanish taxpayers who are part of this type of transaction must submit the documentation of both the group (information relating to the structure, activities, assets or tax situation of the company) and the taxpayer established by regulation.

Exclusion: it is not mandatory to document whether you are subject to the tax consolidation regime or if you are dealing with AIE, UTE, IPO (initial public offering for sale), IPO (public offer for subscription of shares) of less than 250,000 euros (article 18.3, lis).

Transfer Pricing Documentation in Spain

Paragraph 3 of Article 18 of the Law states that taxpayers, in order to prove that the prices in their transactions with related parties have been valued according to the market, must keep the documentation established by Regulation, so that it can be made available to the Tax Administration when required. In relation to this, the Regulations indicate in Articles 13 to 16 the documentation that must be maintained in accordance with the provisions of the law. In accordance with numeral 4 of Article 16 of the Regulation, those persons or entities that do not exceed ten million euros may submit a standardized document in order to comply with the specific documentation required in the aforementioned regulation. Paragraph 4 of Article 16 of the Regulation states that the specific documentation of the taxpayer will be applicable to those whose net turnover is greater than 45 million euros, including the permanent establishments of entities not resident in Spanish territory. In this documentation, information such as the structure of the company, description of its activities, main competitors, detailed information on related-party transactions and economic and financial information of the taxpayer must be included.

COSTA RICA

Pursuant to Article 81 bis of the Costa Rican Income Tax Law, introduced by Law for the Strengthening of Public Finances No. 9635, companies that carry out transactions with their related parties must determine and demonstrate that their intercompany income and deductions are determined as they would have been done by independent entities in comparable transactions. The foregoing, in accordance with the principle of free competition and in accordance with the principle of economic reality. Taxpayers who carry out transactions with related parties must prepare and keep documentation that supports the way in which their transfer prices are adjusted to the prices that would have been agreed by independent third parties under comparable conditions. Likewise, you must have the documentation that supports it, such as contracts and working papers. Taxpayers who are in the following situations are required to file an annual transfer pricing information return with the Directorate-General of Taxation (“DGT”):

- Are classified as large national taxpayers, large territorial companies, or under the free zone regime.

- That carry out intercompany transactions that together represent an amount equal to or greater than 1000 base salaries ($740 thousand dollars) in the corresponding year. However, the system for filing the tax return has not been published by the DGT and therefore there is no definite date for its filing.

In the event that intercompany transactions do not comply with the arm’s length principle, the Tax Administration is empowered to make adjustments to the income or costs derived from such consideration in such a way as to adjust the margins or agreed prices with which independent third parties would have negotiated. Article 9 of the Transfer Pricing Decree in Costa Rica mentions in its first paragraph that the documentation prepared must be available to the Tax Administration, in order to verify compliance with the Arm’s Length Principle. This information must be available for the correct completion of the Information Return, which should be submitted on the last day of June. Therefore, it is recommended that the Transfer Pricing Study be prepared before that date. The Transfer Pricing Study will only be submitted to the DGT in the event of a formal requirement for it.

CHILE

The issue of transfer pricing in Chile regained importance on September 27, 2012, the date on which Law 20,630 was published, modifying the rules on transfer pricing through Article 41 E, which included detailed concepts of the matter, in accordance with the Transfer Pricing Guides of the Organization for Economic Cooperation and Development (“OECD”). this after Chile’s accession to the OECD in 2010. Subsequently, in 2013, SII Exempt Resolution No. 14 was issued, which establishes the filing of the Annual Informative Affidavit of Transfer Pricing (Form 1907). Additionally, in that same year, Circular No. 29 was issued, which included amendments to Law 20,630, clarifying concepts and obligations. On the other hand, in December 2015, the Annual Affidavit of Global Tax Characterization No. 1913 was introduced, through SII Exempt Resolution No. 110, in which qualitative information is requested for the characterization of large taxpayers.

Chile as a member country of the OECD, has continued to introduce changes to this regime since 2016, adapting to Action 13 of the BEPS Plan (Base and Erosion and Profit Shifting), in order to take measures against tax evasion or avoidance. In Chilean legislation, it is established as part of their formal obligations, that taxpayers who carry out operations with related parties must have a Technical Study performed, in accordance with Numeral 3 of Article 41-E of the Law. It also points out that according to Numeral 6 of the aforementioned article, they may also be obliged to submit an affidavit of transfer pricing, according to the forms and deadlines established by the SII. It should be noted that, as of 2016, Chile was adapting to Action 13 of the OECD’s BEPS Plan, introducing the Country-by-Country Report (CBC Report) as one of the three levels of documentation proposed in this action. Subsequently, in August 2020, it introduced the other two levels of documentation such as the Local Report and the Master File. It is recommended that taxpayers prepare their transfer pricing study before the last day of June of each year, since it will serve as a reference for filling out the transfer pricing information return.

CONCLUSION

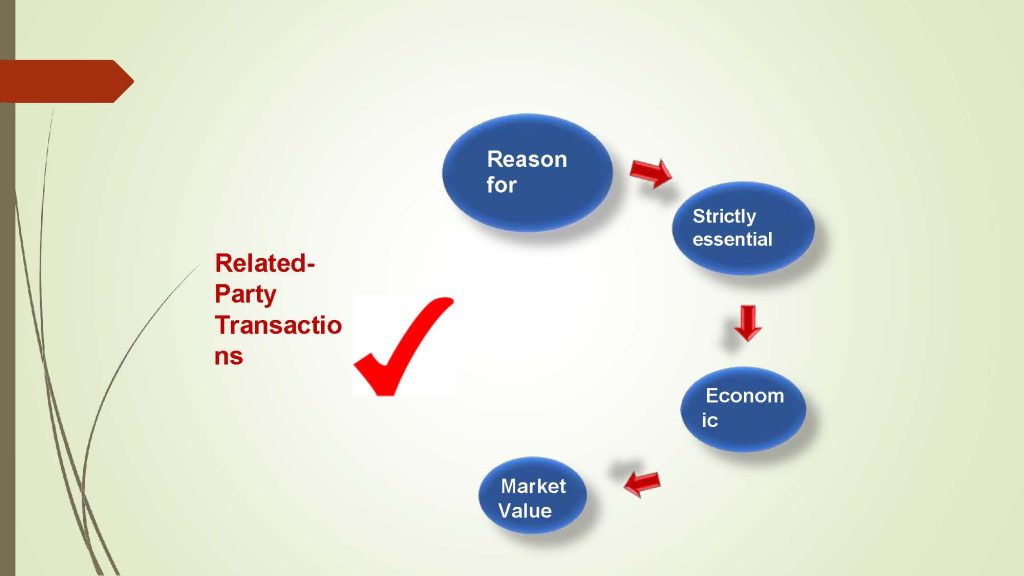

Transactions between related parties need to analyzed in a step wise way

- Look at the Business reason for the transaction

- Evaluate its essential elements

- Compare the Economic substance of the transaction to benchmarks

- Arrive at a transfer price that reflects market value

Download reference file in Spanish: Click here

About the Author:

Salvador Pizano Moreno

Gerente/ Manager

Transfer pricing expert with experience at BDO, Baker Mckenzie, Deloitte, MMRG, with in-depth experience in:

- Business function research

- Analysis of the company’s Balance Sheets and Income Statements

- Review of intercompany operations.

- Research and carrying out economic analysis.

Integra Member Profile:

https://integra-international.net/find-an-integra-firm/find-firm-profile/name/salgado-contadores-s-c/

Firm Website:

https://www.salgadocontadores.com/en/