Author:

Rakesh Ghirah LLM, Associate Partner VAT | Indirect Tax|

Londen & Van Holland

Amsterdam, Netherlands

[email protected]

Edited by:

Grant Gilmour, B.SC., MBA, CPA BC, CA, CPA AZ

Integra Tax World Newsletter Editor

E: [email protected]

Based on the Value Added Tax [VAT] Directive the VAT Law in the European Union is harmonized. In principle a 0% VAT rate applies to Business to Business [B2B] transactions where goods are supplied from one Member State to another. However, this 0% VAT rate can be exploited for carousel fraud, contributing significantly to the VAT Gap in Europe, which was estimated to be around €61 billion in 2021. The VAT Gap is the estimated overall difference between the expected theoretical VAT revenue and the amount actually collected. To reduce the carousel fraud and the VAT Gap, multiple quick fixes have been introduced to limit the potential carousel fraud. These quick fixes include, amongst others, the mandatory usage of a valid VAT number of the recipient to use the 0% VAT rate and requirements to prove the international transport with i.e., CMR-documents [Convention on the Contract for the international Carriage of Goods by Road], proof of payments combined with other information to prove the intra-community transport.

VAT challenges in Europe

Businesses trading across multiple European countries often encounter difficulties to be VAT compliant in all member states. Certain aspects of the VAT Directive are optional for Member States to implement in their own VAT legislation. Whereas some definitions are explained differently within Member States. With the growing globalization, businesses often experience these VAT challenges in member states.

In the text below we describe some VAT challenges in practice.

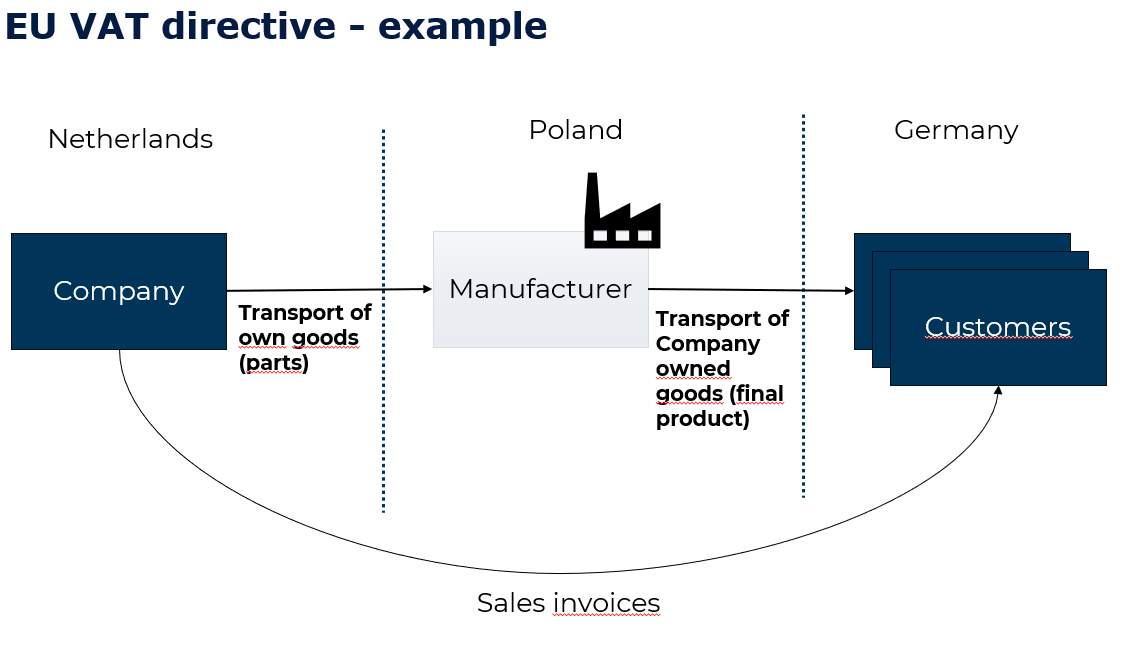

Example 1

In the example below a Dutch company has outsourced parts of their manufacturing process to a manufacturer located in Poland. In this transaction the Dutch company transfers their own product to Poland to have the Polish manufacturer to assemble the final product. After the product is finalized, the Dutch company sells the goods to their final customers in Germany. The 0% VAT rate is applicable on the sale from the Dutch company to the German customer, however, for VAT purposes the flow of goods is leading for the VAT treatment, meaning the Dutch company should register in Poland to declare the 0% VAT rated transaction in Poland. Additionally, the transfer of own goods from the Netherlands to Poland should be declared in both the Dutch and the Polish VAT return of the Dutch company, even though the goods are still owned by the same Dutch company. This example shows that the transfer of own goods to another member state can trigger a VAT registration in that member state, for example with consignment stock at a customer.

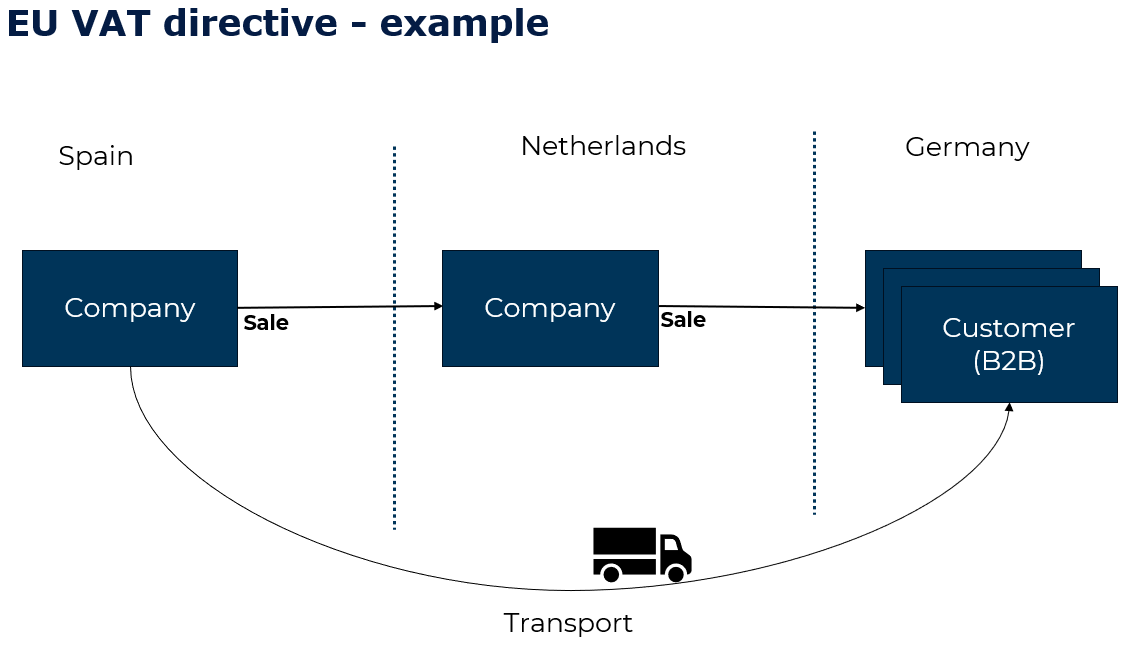

Example 2

A Dutch company purchases goods from a Spanish supplier and sells them to a German customer. When placing the order with the Spanish supplier, the Dutch company already has a purchase order from the German customer, instructing the supplier to deliver the goods directly from Spain to Germany. Because the goods are only transported once in this example, there can only be one Intra-community supply where the 0% rate applies. This means that the Dutch company should most likely register in Germany, because the transport is allocated to the sale between the Spanish supplier and the Dutch company. To prevent the registration of the Dutch company in Germany, the simplified triangulation scheme is introduced in the VAT directive, meaning both the Spanish supplier as the Dutch company can use the 0% VAT rate for an intra-community supply.

These examples illustrate some of the VAT challenges companies face when trading in multiple EU countries. It is crucial for businesses to recognize potential VAT risks in different countries to avoid penalties and ensure a correct international trading. If you or your clients have any questions about the correct VAT treatment with respect to cross border transactions within the EU, please contact Mr. Rakesh Ghirah (associate Partner Indirect Tax) of Londen & Van Holland.

© 2024 Londen & Van Holland All rights reserved. This Article is not intended to provide legal or other advice and you should not take, or refrain from taking, action based on its content. Prior results do not guarantee a similar outcome.

About the Author:

Rakesh Ghirah LLM, Associate Partner VAT | Indirect Tax|

Londen & Van Holland

Rakesh Ghirah is an associate partner of the Indirect Tax department at London & Van Holland. Within the Indirect Tax department, he is involved in VAT and RETT (real estate transfer tax) advice for various types of customers and regularly provides VAT trainings. He also works as a thesis supervisor at the law & tax department of Erasmus University and is the programme coordinator of the Post-Master Indirect Tax at Erasmus Fiscal Studies. He previously worked as a VAT specialist at the Dutch Tax Authorities and the Ministry of Finance of the Netherlands.

Integra Member Profile:

https://integra-international.net/find-an-integra-firm/find-firm-profile/name/rakesh-ghirah/

Firm Website:

http://www.londenholland.nl